Are you struggling with debt and worried about losing your home? You’re not alone. Gaining tips to prevent foreclosure is the go to solution. By proactively managing your finances and staying informed about your rights, you can protect yourself from foreclosure and maintain financial resilience.

This blog post will provide practical tips to help you avoid foreclosure and secure your home. Whether you’re facing financial challenges or simply want to be better prepared for unexpected events, these tips can help you take control of your finances and achieve long-term stability. So let’s get started!

Understanding Foreclosure

Foreclosure is a serious issue that can have significant consequences for both homeowners and lenders. It’s important to understand the foreclosure process so that you can take steps to avoid it if necessary.

Foreclosure is a legal process whereby a lender takes possession of a property because the borrower has failed to repay their loan according to the terms of the agreement. This can happen when someone misses payments or defaults on their mortgage. The lender then sells the property at auction to satisfy the debt.

Foreclosure typically follows these steps:

- Missed Payments: Foreclosure proceedings often begin when you miss several mortgage payments.

- Notice of Default: Your lender will send you a Notice of Default (NOD) when you’re 90 days or more behind on payments.

- Pre-Foreclosure Period: You can catch up on payments or negotiate with your lender during this stage.

- Auction: If you can’t resolve the issue, your home may be auctioned off to the highest bidder.

- Eviction: After the auction, you may face eviction from your home if the new owner decides to take possession.

Common Reasons for Foreclosure

Foreclosure, a distressing situation where a homeowner loses their property due to the inability to meet mortgage obligations, can indeed happen to anyone.

Understanding the common reasons behind foreclosure is crucial for both potential homebuyers and current homeowners to take preventive measures and seek assistance when needed.

One of the primary causes of foreclosure is financial hardship. This can result from various factors, such as unexpected medical expenses, job loss, or a significant reduction in income.

When individuals and families face financial challenges that disrupt their ability to make timely mortgage payments, they become susceptible to the risk of foreclosure. Some of the leading causes include:

- Job Loss: Losing your primary source of income can make it challenging to keep up with mortgage payments.

- Medical Expenses: Unexpected medical bills can strain your finances, making it difficult to cover housing costs.

- Adjustable Rate Mortgages (ARMs): A sudden increase in interest rates can result in higher monthly mortgage payments.

- Divorce or Separation: Dividing assets during divorce can lead to financial instability, potentially impacting your ability to pay your mortgage.

- Excessive Debt: High levels of unsecured debt, such as credit card debt, can make it challenging to meet mortgage obligations.

Practical Tips to Prevent Foreclosure

The looming threat of foreclosure can cast a shadow over homeowners’ lives, but it doesn’t have to be a foregone conclusion. Below, we’re delving into the practical strategies and actionable steps you can take to shield your home from foreclosure’s grasp.

From open communication with lenders to exploring mortgage assistance programs, we’ll guide you through the process of preserving your home and financial stability. Let’s embark on this journey toward securing your home and peace of mind.

- Open Communication with Your Lender

Open and honest communication with your lender is one of the first and most crucial steps in preventing foreclosure. If you anticipate difficulties making your mortgage payments or need to catch up, contact your lender immediately.

They may be willing to work with you to find a solution, such as modifying your loan terms, allowing a temporary forbearance, or establishing a repayment plan.

- Budget and Financial Planning

Assess your financial situation thoroughly. Create a realistic budget that accounts for all your income and expenses. Identify areas where you can reduce spending to allocate more funds toward your mortgage payments.

Financial planning tools and guidance from financial advisors can be invaluable during this process.

- Explore Mortgage Assistance Programs

Many government and nonprofit organizations offer mortgage assistance programs to help distressed homeowners. These programs may provide financial aid, loan modifications, or foreclosure counseling. Research and reach out to these resources to explore your eligibility and options.

- Avoid Unscrupulous “Rescue” Scams

Beware of fraudulent schemes that promise to rescue you from foreclosure for a hefty fee. Scammers often prey on vulnerable homeowners facing foreclosure. Before engaging with such services, seek advice from reputable housing counselors or legal professionals.

- Consider Refinancing or Loan Modification

Refinancing your mortgage or seeking a loan modification can be viable options to reduce your monthly payments and make them more manageable. Consult with financial experts or mortgage lenders to explore whether these options suit your situation.

- Explore Selling Your Home

If you are in a dire financial situation and unable to secure a solution to prevent foreclosure, consider selling your home voluntarily. This can be a more controlled process than foreclosure and may allow you to retain some equity while avoiding the devastating consequences of foreclosure on your credit and housing history.

- Seek Legal Advice

Consulting with a qualified attorney specializing in foreclosure defense can be wise. They can assess your situation, help you understand your legal rights, and represent your interests if necessary.

- Stay Informed About Your Rights

Familiarize yourself with your state’s foreclosure laws and regulations. Understanding your rights as a homeowner can empower you to navigate the process more effectively and make informed decisions.

- Emergency Fund and Savings

Building an emergency fund is a proactive step to prepare for unexpected financial crises. Having savings set aside can help you cover essential expenses, including your mortgage, during challenging times.

- Credit Counseling and Debt Management

Enlist the help of credit counselors or debt management agencies to develop a plan for paying down debt. Reducing other financial obligations can free up resources to meet your mortgage payments.

Impact of Foreclosure on Homeowners

Foreclosure is a harrowing ordeal that can disrupt lives and leave lasting scars. In this blog, we’ll delve into its profound impact on homeowners.

From the loss of their cherished abode to the financial repercussions and emotional toll, we’ll explore how foreclosure can reshape lives and offer insights into how individuals can navigate this challenging journey with resilience and hope.

Join us as we uncover the often-overlooked aspects of foreclosure and shed light on the path to recovery.

- Loss of Home: The most obvious consequence is losing your home. Foreclosure leads to eviction, and you may have to find alternative housing, which can be emotionally and financially distressing.

- Credit Damage: Foreclosure can severely damage your credit score. This can make it difficult to secure loans credit cards, or even rent a new home in the future. It may take years to rebuild your credit.

- Emotional Stress: Losing your home can be emotionally devastating. It can lead to feelings of shame, anxiety, and depression. It’s essential to seek emotional support during this challenging time.

- Financial Consequences: Besides losing your home, you may still owe the lender if the property sale doesn’t cover the full amount of your mortgage debt. This is a deficiency, and the lender may pursue legal action to collect it.

- Impact on Future Housing: Foreclosure can make qualifying for a new mortgage challenging, and you may have to rent for an extended period. Landlords often check credit histories, and a foreclosure can make you a less desirable tenant.

- Stigma: Unfortunately, there can be a social stigma associated with foreclosure. Some people may view it as a sign of financial mismanagement, even though many factors beyond a homeowner’s control can lead to foreclosure.

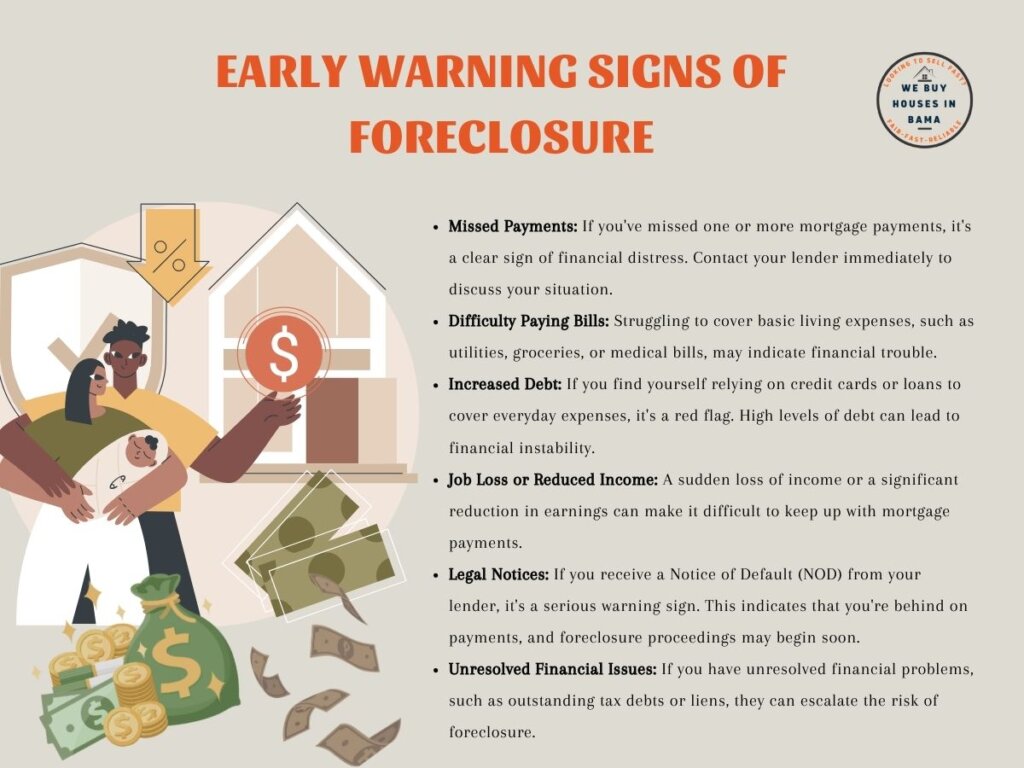

Early Warning Signs

Recognizing the early warning signs of financial trouble is crucial for safeguarding financial stability and preventing potential crises like foreclosure. This brief guide will investigate the telltale indicators that signal impending financial difficulties.

By staying vigilant and taking proactive steps when you spot these signs, you can take control of your finances and steer clear of more significant financial setbacks. Let’s explore these red flags that should never be ignored:

- Missed Payments: If you’ve missed one or more mortgage payments, it’s a clear sign of financial distress. Contact your lender immediately to discuss your situation.

- Difficulty Paying Bills: Struggling to cover basic living expenses, such as utilities, groceries, or medical bills, may indicate financial trouble.

- Increased Debt: If you find yourself relying on credit cards or loans to cover everyday expenses, it’s a red flag. High levels of debt can lead to financial instability.

- Job Loss or Reduced Income: A sudden loss of income or a significant reduction in earnings can make it difficult to keep up with mortgage payments.

- Legal Notices: If you receive a Notice of Default (NOD) from your lender, it’s a serious warning sign. This indicates that you’re behind on payments, and foreclosure proceedings may begin soon.

- Unresolved Financial Issues: If you have unresolved financial problems, such as outstanding tax debts or liens, they can escalate the risk of foreclosure.

Conclusion

Homeowners must understand the foreclosure process, its common causes, and the potential consequences. By recognizing the early warning signs of financial distress and taking proactive steps, such as communicating with your lender and seeking assistance, you can work towards avoiding foreclosure and maintaining your financial stability.

Remember that resources and programs are often available to help homeowners in challenging situations, so don’t hesitate to explore your options.