If you’ve been considering buying, selling, or investing in Alabama’s real estate, you might be wondering how to time your decisions just right. Alabama’s real estate market has its own rhythm, influenced by factors unique to the state.

Knowing where we are in the market cycle can help you better predict what might be coming next. This can mean the difference between finding a great deal and paying more than you should.

You don’t need to be an expert to understand these cycles, but a little knowledge can go a long way in helping you make informed decisions.

Real Estate Market Cycles

When you think about making a big decision in real estate, timing often plays a crucial role. The market doesn’t stay static; it ebbs and flows, and these changes can impact your choices more than you might realize.

The real estate market cycle isn’t a mystery, but it does require a bit of knowledge to grasp fully. These cycles are not random—they follow a pattern influenced by economic conditions, supply and demand, and various other factors.

What are Real Estate Market Cycles?

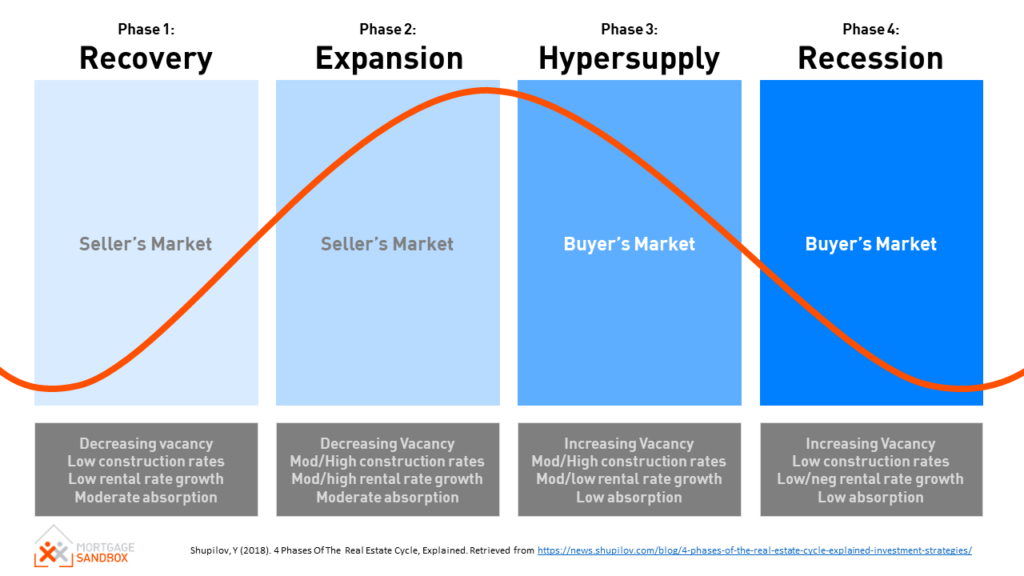

Real estate market cycles are essentially the stages the market goes through over time. These cycles typically consist of four main phases: expansion, peak, contraction, and trough, or recovery, expansion, hypersupply, and recession.

- During the expansion phase, the market is growing. You might see property values rising, new construction projects, and increased demand for homes.

- As the market reaches its peak, prices are at their highest, and it might become harder to find good deals.

- The contraction phase follows, where demand decreases, and prices start to fall.

- The trough is where the market hits its lowest point, often presenting opportunities for those looking to buy.

Each phase has its own characteristics that affect property values, availability, and demand.

Why Do Market Cycles Matter?

Knowing where the market is in its cycle can help you make smarter decisions. For instance, buying during a trough can mean lower prices, while selling at the peak can maximize your profits.

These cycles aren’t just about numbers; they reflect the broader economic environment and can impact everything from your mortgage rate to the speed of your property sale. Market cycles also influence how long you might hold onto a property.

If you’re investing, understanding the cycle can help you decide when to buy and when to sell to get the best return. Even if you’re simply buying a home to live in, knowing the cycle can help you avoid overpaying or buying at a time when property values are about to drop.

Alabama’s Real Estate Market

Alabama’s real estate market has its own unique dynamics, shaped by the state’s diverse economy, population trends, and regional differences. The market here doesn’t always follow national trends, so having a solid grasp of the local landscape can help you make more informed decisions.

Historical Trends

Looking back at Alabama’s real estate history, you’ll notice a pattern of ups and downs, similar to the national market but with its own regional twists. Over the past few decades, Alabama has seen periods of significant growth, particularly in urban areas like Birmingham, Huntsville, and Montgomery.

These cities have experienced increased demand for housing, driven by factors like job growth and population influx. On the other hand, rural areas of Alabama have sometimes experienced slower growth, with property values remaining more stable over time.

The housing market in these areas is often less volatile, offering different opportunities and challenges compared to urban markets.

Current State of the Market

As of now, Alabama’s real estate market is in a phase of steady growth, with certain areas experiencing rapid expansion. Cities like Huntsville have become hotspots for real estate activity thanks to a strong job market and an influx of new residents.

This growth is driving up property values, making it a competitive market for buyers and a lucrative one for sellers. However, it’s not the same story across the entire state.

Some regions, particularly rural areas, continue to see more modest growth. The current market conditions offer a mix of opportunities, depending on where you’re looking.

Key Factors Influencing Alabama’s Market Cycles

These factors don’t just change the market on a surface level; they can deeply affect when and where opportunities arise. The market cycles in Alabama are shaped by a combination of economic, demographic, and governmental influences.

These factors interact in complex ways, often creating conditions that are unique to specific regions within the state.

Economic Indicators

In Alabama, factors such as employment rates, income levels, and the performance of key industries like manufacturing, aerospace, and healthcare significantly influence the real estate market. When the economy is strong, more people have the financial stability to buy homes, leading to higher demand and rising property values.

Conversely, during economic downturns, you might see a slowdown in the market as fewer people are in a position to buy. Job losses or decreases in income can lead to lower demand, causing property values to drop.

Population Growth and Demographics

Areas with strong population growth, like Huntsville and Birmingham, often experience increased demand for housing, driving up property prices. This growth is typically fueled by job opportunities, quality of life, and other factors that attract new residents.

Demographic shifts also play a role. For instance, an influx of younger professionals might drive demand for different types of housing compared to a growing population of retirees.

Government Policies and Regulations

Government actions at the state and local levels can have a significant impact on Alabama’s real estate market cycles. Policies related to property taxes, zoning laws, and incentives for development can either stimulate or slow down market activity.

For example, tax incentives for homebuyers or developers can lead to a surge in new construction, altering the balance of supply and demand. On the other hand, strict zoning regulations or high property taxes might slow down development, affecting the availability of housing and pushing property values higher.

Regional Variations Within Alabama

Alabama is a state with diverse regions, each with its own unique characteristics that impact the local real estate market. The factors that influence real estate cycles in Alabama don’t operate uniformly across the state.

Local economies, population growth, and even specific industries can create distinct market environments in different areas.

Urban vs. Rural Markets

Urban areas like Birmingham, Huntsville, and Mobile often experience faster-paced real estate cycles compared to rural parts of Alabama. In these cities, factors like job growth, infrastructure development, and higher population density drive demand for housing, leading to quicker shifts in market conditions.

You might see rapid price increases during periods of expansion and steeper declines during contractions. In contrast, rural markets tend to be more stable, with slower growth and less volatility.

Property values in these areas don’t fluctuate as wildly, which can make them attractive for buyers seeking long-term stability. However, this also means that opportunities for quick profits through buying and selling are less common.

Impact on Local Industries

The presence of key industries in specific regions of Alabama also plays a significant role in shaping local real estate cycles. For example, Huntsville’s real estate market has been heavily influenced by the aerospace and defense industries, which have attracted a highly skilled workforce and spurred demand for housing.

Similarly, areas along the Gulf Coast, like Gulf Shores, are impacted by the tourism industry, which can create seasonal variations in the market. In regions where a single industry dominates, the real estate market can be particularly sensitive to changes in that industry’s fortunes.

Predicting Future Market Trends in Alabama

When you think about the future of Alabama’s real estate market, it’s natural to wonder how current trends might evolve and what that means for your buying, selling, or investment plans. While no one can predict the future with absolute certainty, understanding the factors at play today can give you a better sense of where the market might be headed.

What to Watch For

Economic growth, job creation, and wage increases can drive demand for housing, leading to rising property values. Conversely, economic downturns can result in decreased demand and falling prices.

Areas that are attracting new residents, such as Huntsville, are likely to see continued demand for housing, which can drive up prices. On the other hand, regions with stagnant or declining populations might experience slower market activity.

Expert Opinions

Real estate experts often provide valuable insights into future market trends based on their experience and analysis of current conditions. Many experts are optimistic about the continued growth of Alabama’s real estate market, particularly in regions with strong job markets and population growth.

However, they also caution that rising interest rates or economic slowdowns could temper this growth. Listening to expert opinions and combining them with your own research can help you form a more complete picture of where the market is headed.

Strategies for Buyers, Sellers, and Investors

The market’s cycles can present both opportunities and challenges and understanding how to position yourself within these cycles can make a significant difference. Each role in the real estate market—buyer, seller, or investor—requires a different mindset and set of tactics.

The strategies that work well in a buyer’s market might not be as effective when the market favors sellers, and investors need to be particularly attuned to timing and market trends.

For Buyers

If you’re looking to buy property in Alabama, timing your purchase according to the market cycle can be key to getting the best deal. During a contraction or trough phase, when prices are lower, you may find better opportunities for negotiation and potentially lower competition from other buyers.

Cities like Huntsville, which continue to attract new residents and businesses, often offer opportunities for property appreciation over time. If you’re buying with an eye toward investment, considering the future growth of the area can be just as important as finding the right property.

For Sellers

For sellers, understanding the market cycle can help you time your sale for maximum profit. Selling during a peak phase, when demand is high and prices are at their maximum, can help you achieve a higher sale price.

However, it’s also important to be aware of the signs that the market is shifting toward a contraction phase, as this could mean a decrease in buyer interest and property values. Preparing your property to stand out in the market can also make a big difference, especially in a competitive environment.

For Investors

Investors need to be particularly attuned to the timing of market cycles, as well as the economic and demographic factors that influence them. Purchasing property during a trough, when prices are lower, can set you up for significant gains when the market enters an expansion phase.

However, this strategy requires patience and a willingness to wait for the market to recover. Diversifying your investments across different regions within Alabama can also help mitigate risk.

For example, investing in both urban areas with strong job growth and rural areas with stable property values can provide a balanced portfolio that is less vulnerable to market fluctuations.

The Impact of Real Estate Market Trends in Alabama

Knowing the cycles of Alabama’s real estate market can offer you a significant advantage whether you’re investing, buying, or selling. The market is more than just statistics; it’s also about time, strategy, and understanding when to act.

Trends and cycles are intertwined—trends give you insight into what’s driving the market now while understanding cycles helps you see where it’s likely to go next. It’s easier to move confidently in Alabama’s real estate market if you keep an eye on these trends and comprehend the cycles that underlie them.

In the end, it’s all about being prepared and informed. Whether you’re trying to buy at the right time, sell for the best price, or invest with an eye on future gains, understanding these market dynamics helps you make decisions that truly benefit you.