Are you looking for ways on how to avoid home-buyers remorse in Alabama? Buying a home is one of the most significant investments you’ll make in your lifetime, a decision that should be made with utmost care and consideration. It’s an exciting journey filled with dreams of a perfect living space for you and your family.

However, this journey can sometimes lead to buyer’s remorse if not navigated properly. In Alabama’s diverse and unique real estate market, home buyers can be overwhelmed with options, leading to hasty decisions and potential regrets.

This article aims to guide you through the intricacies of buying a home in Alabama, offering practical steps to ensure you make a choice that brings long-term satisfaction rather than fleeting excitement. Let’s start!

1. Understand the Alabama Real Estate Market

Every real estate market is unique, and Alabama is no exception. Familiarize yourself with the housing trends, average prices, land surveys, and local economy in the specific Alabama area where you plan to buy.

Websites like Zillow, Realtor, and the Alabama Center for Real Estate can provide valuable data. This research will give you an idea of what to expect, help you set a realistic budget, and prevent you from overpaying.

2. Get Pre-approved for a Mortgage

Before setting out on your home-hunting expedition, getting pre-approved for a mortgage is highly recommended. This serves multiple purposes; firstly, it gives you a definitive understanding of your budget, further refining your search. It also sends a strong message to sellers that you’re serious and committed to the home-buying process, making you a more appealing candidate.

However, this pre-approval amount should not be considered an encouragement to spend to the limit. Remember, the mortgage approval sum is a ceiling, not a target. Be mindful that just because you’re approved for a certain amount doesn’t mean you should necessarily spend that much.

It’s important to factor in other financial obligations, future expenditures, and overall financial goals when determining your budget for a house. You wouldn’t want to stretch yourself too thin and risk the stability of your financial future.

It’s all about finding the perfect balance that would allow you to afford your new home while keeping your finances healthy comfortably.

3. Hire an Experienced Local Realtor

Retaining the services of an experienced local realtor can be a game-changer in your journey to avoid buyer’s remorse. A seasoned realtor with extensive knowledge and experience in the Alabama market can be your invaluable guide in this expedition.

They have the proficiency to match you with properties that align with your needs, desires, and budget. Realtors adept in negotiation can ensure you get the best value for your money and can navigate through the intricate maze that is the Alabama home-buying process.

Additionally, they can offer insights into community aspects you may not be aware of, further assisting in making an informed decision. Ultimately, a trustworthy realtor is your advocate, facilitating a smoother and more enjoyable home-buying experience.

4. Prioritize Your Needs and Wants

Strategic planning is a vital part of the home-buying process. Begin by creating a list outlining your ‘must-haves’ and ‘nice-to-haves’ for your prospective home. This list should encompass everything from the number of bedrooms and bathrooms needed, the type of neighborhood you envision living in, and even smaller details such as a yard size or a specific architectural style.

Prioritizing these aspects based on your lifestyle, family size, work situation, and personal preferences is key to refining your search. However, remember that finding the perfect home involves balancing your dream and reality, so being open to compromise is crucial.

Yet, standing firm on your essential needs is equally important, as this ensures your ultimate satisfaction

with your purchase. A clear vision of your non-negotiables versus your flexible wants can streamline your decision-making process and alleviate potential disappointment post-purchase.

5. Conduct a Thorough Home Inspection

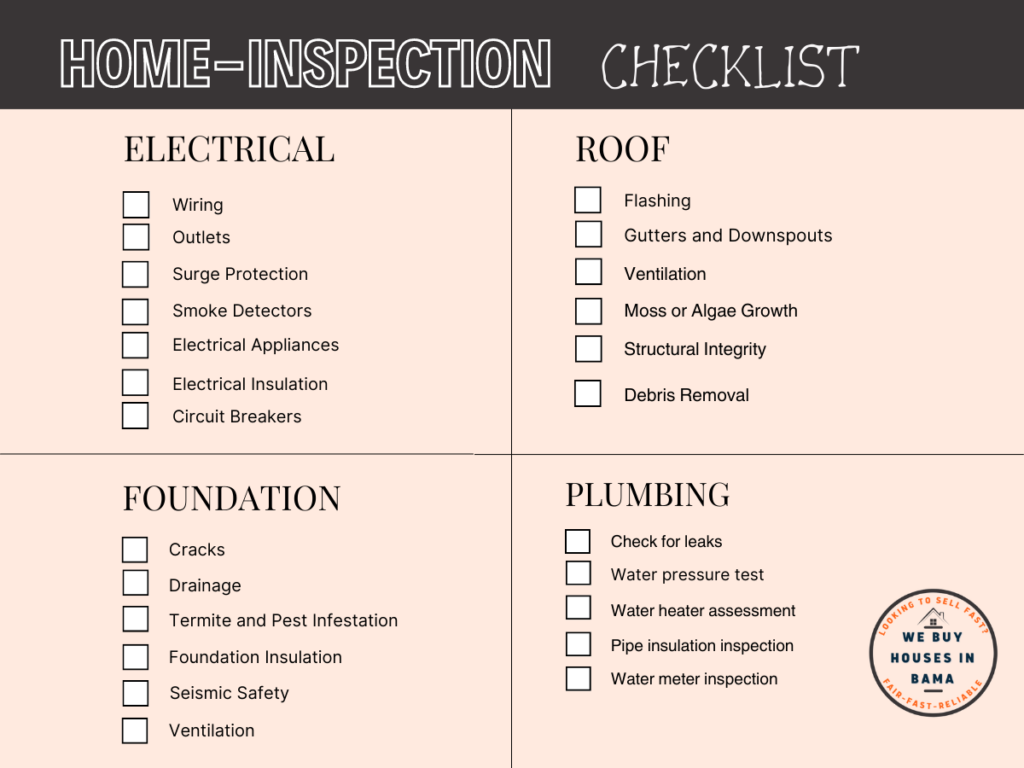

A thorough home inspection is an essential step in the home-buying process that should not be overlooked. This involves a professional examination of the home’s physical structure and mechanical systems, including the roof, HVAC system, plumbing, and electrical systems. This assessment will reveal any potential problems that could become costly repairs in the future, like structural issues, aging roofing, plumbing anomalies, or faulty electrical wiring.

Specifically, in Alabama, certain areas are particularly prone to termite infestations due to the state’s climate and conditions. Thus, in addition to a general home inspection, it is highly recommended to have a separate termite inspection to avoid potential damage and costly extermination procedures down the line.

Being aware of these potential issues beforehand saves you money and offers invaluable peace of mind. Armed with this information, you can negotiate repairs with the seller or adjust your offer price accordingly, ensuring you make a confident and informed decision.

6. Consider the Location

While house hunting, don’t overlook the importance of location due to the house’s features. You can renovate a house, but you can’t change its location. Consider proximity to quality schools, which adds value to your home. Also, access to essential amenities like shopping and medical facilities greatly enhances your quality of life.

Lastly, consider your commute time to work, as longer commutes can add to your stress and reduce personal time. Test out the commute during your regular hours before purchasing. Remember, you can always change the house, but you can’t change its location.

7. Think Long-Term

Navigating the home-buying process also necessitates making decisions that aren’t solely based on current circumstances but also take into account future possibilities and potential challenges. Avoid impulsive choices that may look attractive now but might not serve your evolving needs.

Consider the long-term implications of the home you’re considering by answering these questions:

- Is the space sufficient for your family to grow or for a home office if your work situation changes?

- How does the home fare in terms of potential resale value?

- Can you sustain the mortgage payments if income is lost due to unforeseen circumstances?

This helps you go beyond immediate appeal and aesthetics. This forward-looking approach ensures that you’re not just making an emotionally driven purchase but a sound, future-proof investment. A home that fits into your life’s bigger picture reduces the likelihood of regret and contributes to a sense of satisfaction and stability in the years to come.

8. Be Ready to Walk Away

Even if you’ve invested much time and emotional energy into a house, be prepared to walk away if there are too many red flags. There will always be other homes, and it’s better to wait than rush into a purchase you’ll regret.

Like anywhere else, buying a home in Alabama can be an emotional roller coaster. But you can avoid buyer’s remorse with careful preparation, informed decisions, and a steady focus on your needs and goals.

Final Words

Preventing homebuyers’ remorse in Alabama requires meticulous research, judicious financial choices, and understanding your needs. Despite the complexities of home buying, these strategies equip you for confident, informed decisions.

Remember, it’s acceptable to withdraw if a home isn’t right for you. The goal isn’t just to buy a house— to find a home you’ll be happy in for years to come. With careful planning, you can successfully traverse Alabama’s unique real estate market, secure a home that genuinely fits your needs, and bypass homebuyer’s remorse.