The validity and clarity of the contractual agreement form the cornerstone of each successful real estate transaction. The agreements between buyers and sellers that specify the conditions and responsibilities are found in real estate contracts.

They include essential legal terms that form the foundation of the deal and guarantee justice, safety, and adherence to relevant legal requirements. These contractual components—which include identifying the parties, detailing the property, and laying out contingencies—form the foundation for the entire transaction.

For the contract to be deemed legitimate and enforceable, each condition has particular ramifications and obligations that must be fulfilled. Furthermore, ignoring or failing to effectively handle these conditions may eventually result in disagreements, monetary losses, and even legal implications.

Understanding Real Estate Contracts

The terms and conditions of a property transaction are outlined in a legally enforceable document called a real estate contract, which is also sometimes referred to as a purchase agreement or sales contract. Any property transaction is anchored by real estate contracts, which specify the conditions and commitments that buyers and sellers must fulfill at every stage of the deal.

- These contracts usually contain information about the parties involved, the property’s description, the purchase price, and any conditions or contingencies that need to be fulfilled in order for the sale to go through.

- The names and addresses of the buyer(s) and seller(s), as well as any other parties engaged in the transaction, such as real estate agents or attorneys, are usually included in the identification of the parties.

The contract makes it clear which parties are in charge of carrying out every obligation and who has the right to sign it. It also guarantees that lines of communication stay open during the transaction, which makes it easier to coordinate and resolve any potential problems.

Essential Legal Conditions in Real Estate Contracts

To safeguard the interests of all parties concerned, it is essential to incorporate specific legal criteria when creating or reviewing a real estate contract. These terms operate as safety nets, elucidating rights, obligations, and possible consequences during the course of the transaction.

Realizing that real estate contracts are legally enforceable is one of the most important parts of understanding them. Legally speaking, a contract must satisfy a number of requirements in order to be enforceable, such as the capacity of the parties, consideration, mutual consent, and the legality of the purpose.

For real estate contracts to be upheld in court, they must follow certain guidelines. As a result, it is the responsibility of both buyers and sellers to guarantee that the conditions contained in the contract are reasonable, transparent, and compliant with all relevant laws and rules.

1. Identification Of The Parties Involved

The full legal names, addresses, and phone numbers of the buyer(s) and seller(s) are normally included in this contract portion. It might also list any other participants in the deal, including escrow agents, lawyers, or real estate brokers.

The identification of the parties serves several important purposes.

- It establishes who the contract is between, clarifying the roles and obligations of each party. Including contact information enables effective communication between the parties, facilitating the exchange of important documents, updates, and inquiries.

- It helps verify a party’s legal capacity to enter into the contract. For example, if one of the parties is a corporation or LLC, the contract should specify the entity’s full legal name and registered address. Similarly, if an attorney or agent represents the buyer or seller, their contact information should be included to confirm their authority to act on behalf of the principal.

- It specifies the rights and obligations of each individual party in a case with multiple buyers or sellers, including their respective ownership interests and responsibilities. This helps prevent misunderstandings and disputes over the division of proceeds, liability for expenses, and other aspects of the transaction.

- Including identification details in the contract helps establish a clear record of the transaction, which can be useful for legal and administrative purposes. This documentation may be required for tax reporting, title transfer, financing approvals, and other aspects of the transaction process.

2. Description Of The Property

The description of the property outlines the specifics of what is being bought or sold providing clarity regarding the property’s location, boundaries, physical characteristics, and any additional features or amenities included in the transaction. The description of the property should begin with its precise location, typically including the street address, city, state, and zip code.

- This information helps uniquely identify the property and ensures there is no ambiguity regarding its whereabouts. Additionally, if the property consists of multiple parcels or units, each should be clearly identified to avoid confusion.

- It details the boundaries of the property, including its dimensions, lot size, and any relevant landmarks or reference points. This helps establish the extent of the property being transferred and provides clarity regarding its physical boundaries.

- It includes its physical characteristics and features. This may encompass details such as the type of dwelling (e.g., single-family home, condominium, townhouse), the number of bedrooms and bathrooms, square footage, and any notable architectural or design elements.

The property description may also include information about its condition, history, or zoning designation. This could include disclosures regarding any known defects, renovations, or environmental hazards, as well as details about past land use or development.

3. Purchase Price And Payment Terms

The purchase price and payment terms outline the financial aspects of the transaction, including the agreed-upon price for the property and the terms for payment. This establishes the buyer’s and seller’s financial obligations and ensures clarity and transparency throughout the transaction process.

- The purchase price represents the amount the buyer agrees to pay the seller for the property. It should be clearly stated in the contract, using both numerical figures and written words to avoid any ambiguity. Additionally, any factors that may affect the final purchase price, such as adjustments for prorated taxes or credits for repairs, should be specified.

- The payment terms outline how and when payments will be made, including details such as the amount of the earnest money deposit, which the buyer typically pays as a show of good faith to secure the transaction. The contract should specify the deposit amount, how it will be held, and any conditions under which it may be forfeited or refunded.

The contract may include provisions for prorating expenses such as property taxes, homeowner association fees, or utility bills between the buyer and seller. These prorations ensure that each party pays their fair share of expenses based on the closing date and help avoid disputes over financial responsibilities.

4. Contingencies

Contingencies allow a buyer or seller to back out of the agreement under certain specified conditions without facing legal consequences. These conditions provide protection and flexibility to the parties involved, allowing them to address potential issues that may arise during the transaction process.

- The financing contingency allows the buyer to withdraw from the contract if they cannot secure adequate financing. It typically specifies when the buyer has to obtain a mortgage loan and may outline the terms under which the buyer can terminate the contract if financing falls through.

- The home inspection contingency allows the buyer to have the property inspected by a professional inspector to identify any potential issues or defects. This contingency helps protect buyers from unforeseen expenses or liabilities associated with the property’s condition.

- An appraisal contingency allows the buyer to cancel the contract or renegotiate the purchase price if the property appraises for less than the agreed-upon price. This contingency helps ensure buyers do not overpay for a property worth less than initially anticipated.

Other contingencies that may be included in a real estate contract include the sale of the buyer’s current home, the seller’s ability to find suitable housing or the completion of certain repairs or improvements to the property. Each contingency serves a specific purpose in addressing potential risks or uncertainties associated with the transaction, providing peace of mind to both buyers and sellers.

5. Disclosures

Disclosures in a real estate contract are essential for ensuring transparency and informing both buyers and sellers about important aspects of the property and transaction. These disclosures are mandated by law and serve to protect all parties involved by providing relevant information that could impact the decision-making process.

- The seller disclosure statement requires the seller to disclose any known defects or issues with the property, including past renovations, repairs, or damage. Sellers must typically disclose information about the property’s structural integrity, plumbing, electrical systems, environmental hazards, and other pertinent details that could affect its value or desirability.

- The lead-based paint disclosure is mandated by federal law for residential properties built before 1978. This disclosure requires sellers to inform buyers about the presence of lead-based paint or lead-based paint hazards in the property and provide a pamphlet on lead-based paint hazards.

- There may be other disclosures required by state or local laws, such as disclosures related to natural hazards, zoning restrictions, or homeowner association rules. These disclosures vary depending on the location of the property and may include information about flood zones, earthquake risks, radon levels, or neighborhood nuisances.

Real estate contracts may also include provisions for voluntary disclosures that provide additional information about the property or transaction. For example, sellers may choose to disclose information about recent upgrades or improvements, neighborhood amenities, or upcoming development projects that could impact the property’s value.

6. Timeline and Deadlines

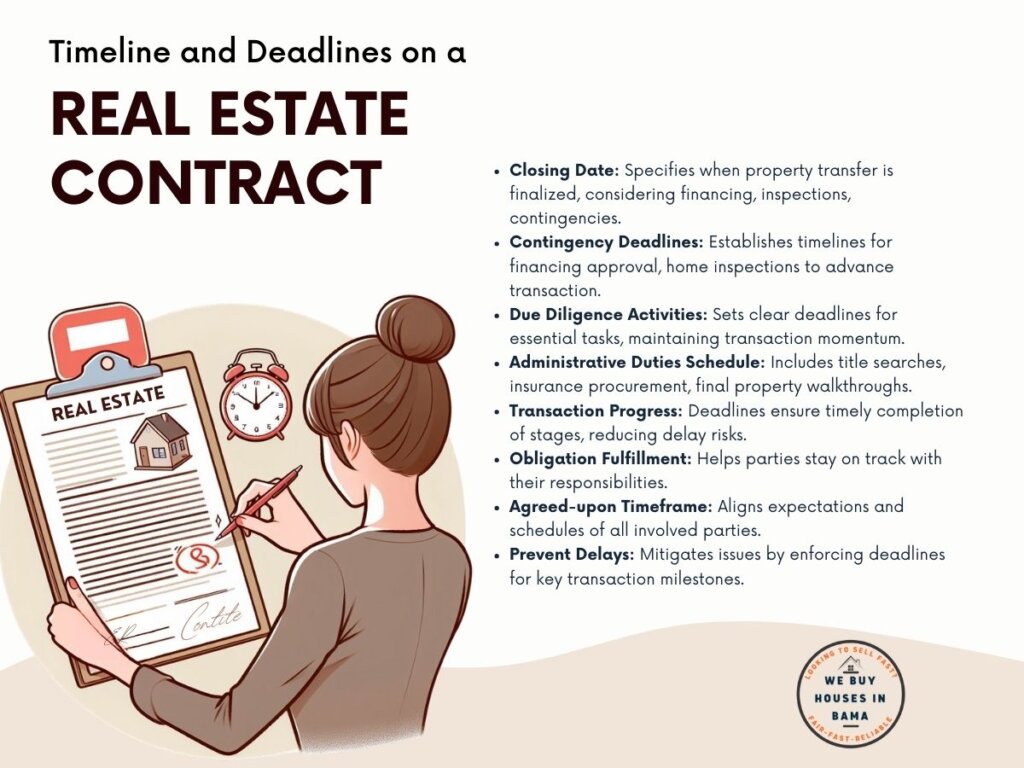

The timeline and deadlines section of a real estate contract establish the schedule for key milestones and actions to be completed throughout the transaction process. This section helps ensure that the parties involved stay on track and fulfill their obligations within the agreed-upon timeframe.

- The closing date represents the day on which the property officially changes hands, and the sale is finalized. The contract should specify the agreed-upon closing date, taking into account factors such as the time needed to secure financing, complete inspections, and satisfy any other contingencies.

- The deadlines for various contingencies and due diligence activities help keep the transaction moving forward and provide a clear timeline for completing essential tasks. For example, the contract may specify the deadline for the buyer to obtain financing approval or complete a home inspection.

The schedule for other administrative duties, such finishing title searches, getting insurance, or setting up a last tour of the property, could be specified in the contract. The contract helps guarantee that all important stages are performed on time by setting deadlines for these tasks, which lowers the possibility of delays or issues before the close.

Easy Guide to Alabama Real Estate Taxes

Understanding the legal framework surrounding real estate contracts provides a solid foundation for navigating the complexities of property transactions, including tax implications.

Just as legal conditions ensure clarity, transparency, and protection for all parties involved in a real estate transaction, knowledge of Alabama real estate taxes is essential for making informed financial decisions and complying with tax obligations.

An easy guide to Alabama real estate taxes can provide valuable insights into property tax rates, assessment procedures, exemptions, and other tax-related considerations that may impact buyers, sellers, and property owners.

In essence, while legal conditions in real estate contracts establish the framework for the transaction process, awareness of real estate taxes ensures compliance with tax obligations and helps optimize financial outcomes.