Understanding property taxes in Huntsville is essential for homeowners and property managers. Tax rates vary by property type, with different rates for residential, commercial, farmlands, and managed forests.

Exemptions like the Alabama Homestead Exemption can significantly reduce the tax burden for eligible property owners. This guide explores the intricacies of property tax rates and exemptions, providing valuable insights to help you manage your property taxes effectively and take full advantage of available benefits.

Property Tax Basics

Property taxes are a significant source of revenue for municipalities, funding essential services such as education, infrastructure, emergency services, and public utilities. In Huntsville, understanding how property taxes are calculated, the current tax rates, billing cycles, and available payment methods can help property owners manage their financial responsibilities effectively.

Property Tax Calculation

Property taxes in Huntsville are calculated based on two main factors: the property’s assessed value and the Council-approved property tax rate. The assessed value of a property is determined by the Municipal Property Assessment Corporation (MPAC), which evaluates properties every four years to reflect changes in the real estate market and any improvements made to the property. The assessed value represents the estimated market value of the property as of a specific valuation date.

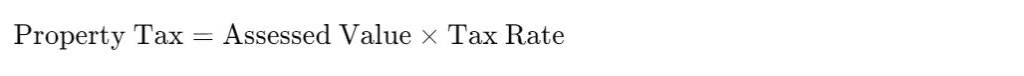

Once the assessed value is established, the Huntsville Town Council sets the property tax rate, which is expressed as a percentage of the property’s assessed value. The tax rate is determined annually and is based on the municipality’s budgetary needs and the total assessed value of all properties within the jurisdiction. The formula for calculating property taxes is as follows:

For example, if a property has an assessed value of $500,000 and the tax rate is 1.25%, the annual property tax would be $6,250.

Tax Rates and Calculations

The property tax rates in Huntsville are updated each spring following the approval of the annual budgets by Huntsville and the District of Muskoka. These budgets outline the financial requirements for the upcoming year, including expenditures for public services, capital projects, and debt servicing. The tax rates are then adjusted accordingly to ensure the municipality can meet its financial obligations.

The tax rate consists of several components, including the municipal tax rate, the district tax rate, and the education tax rate. Each of these components is allocated to fund specific areas of public services:

- Municipal Tax Rate: Funds local services such as road maintenance, waste management, parks, and recreation.

- District Tax Rate: Contributes to regional services like social services, health services, and transportation.

- Education Tax Rate: Allocated to public and separate school boards for educational services.

Property Tax Bills

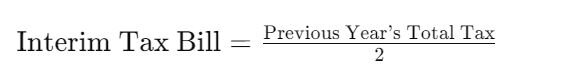

Property taxes in Huntsville are billed twice a year through interim and final tax bills. The interim tax bill, issued in March, represents 50% of the previous year’s total tax amount and provides the municipality with early revenue to cover operational costs until the final tax rates are set. The final tax bill, issued in August, reflects the actual tax rates for the current year and adjusts for any differences from the interim bill.

The interim tax bill is calculated using the following formula:

The final tax bill is then calculated by subtracting the interim tax bill from the total annual property tax based on the current year’s assessed value and tax rate. Property owners are required to pay both the interim and final tax bills by the due dates to avoid penalties and interest charges.

Payment Options

Huntsville offers several convenient payment methods for property taxes, ensuring property owners can choose the option that best suits their needs. These methods include:

- Online Payments: Property taxes can be paid online through the municipality’s website or through online banking services provided by financial institutions. This method is quick, secure, and allows for easy record-keeping.

- Debit Payments: Property owners can pay their taxes using debit cards at the municipal office. This method provides an immediate transaction confirmation.

- Pre-Authorized Payment Plans: The municipality offers pre-authorized payment plans, allowing property owners to have their tax payments automatically deducted from their bank accounts on a monthly basis. This method helps to spread the tax burden evenly throughout the year and ensures timely payments.

- In-Person Payments: Payments can be made in person at the municipal office using cash, cheque, or debit cards. This option provides direct interaction with municipal staff for any questions or concerns.

- Mail Payments: Property owners can mail their cheques to the municipal office. It is important to ensure the payment is sent well in advance of the due date to avoid late fees.

Tax Rates by Property Type

Property taxes are an essential part of homeownership and property management, providing critical funding for public services. However, not all properties are taxed equally. In Huntsville, tax rates vary by property type, and several exemptions can significantly reduce the tax burden for eligible property owners. Let’s delve into the nuances of tax rates for different property types and highlights key tax exemptions, such as the Alabama Homestead Exemption.

Tax Rates by Property Type

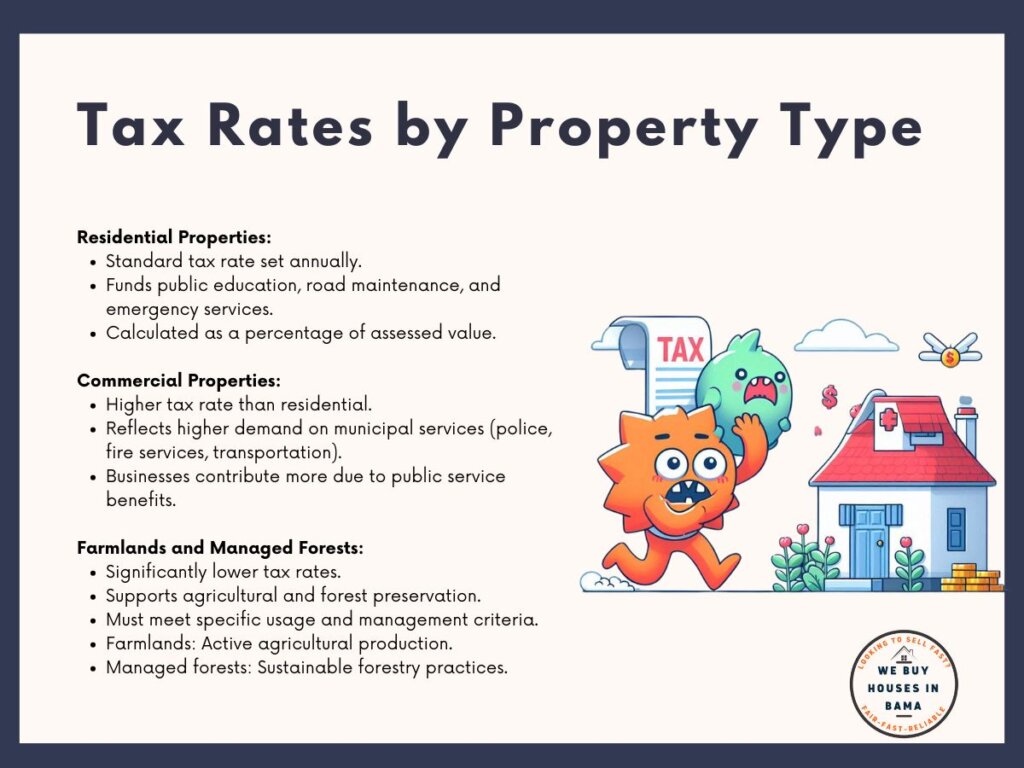

The property tax rates in Huntsville are not uniform; they vary depending on the type of property. This differentiation ensures that tax rates align with the property’s usage and the value it adds to the community. The primary property categories include residential, commercial, farmlands, and managed forests.

- Residential Properties: Residential properties generally face a standard property tax rate, which is set annually based on the municipality’s budgetary needs. These rates fund essential services like public education, road maintenance, and emergency services. The tax rate for residential properties is typically straightforward and calculated as a percentage of the property’s assessed value.

- Commercial Properties: Commercial properties are taxed at a higher rate than residential properties. This higher rate reflects the increased demand commercial properties place on municipal services and infrastructure. Businesses benefit from public services, such as police protection, fire services, and transportation infrastructure, and thus contribute more through higher tax rates.

- Farmlands and Managed Forests: Tax rates for farmlands and managed forests are significantly lower than those for residential and commercial properties. This lower rate recognizes the importance of preserving agricultural and forested lands and supports the sustainability of these resources. Farmlands and managed forests contribute to the local economy and environment by providing food, raw materials, and maintaining ecological balance.

To qualify for the lower tax rates, farmlands and managed forests must meet specific criteria regarding usage and management practices. For example, farmlands must be actively used for agricultural production, while managed forests must follow sustainable forestry practices.

Tax Exemptions

In addition to varying tax rates by property type, several exemptions can reduce the overall property tax burden for eligible property owners. One of the most significant exemptions available in Huntsville is the Alabama Homestead Exemption.

- Homestead Exemption: The Alabama Homestead Exemption is designed to provide tax relief to homeowners who occupy their property as their primary residence. This exemption can reduce property taxes by up to half for eligible homeowners, making homeownership more affordable. To qualify for the Homestead Exemption, homeowners must meet the following criteria:

- Primary Residence: The property must be the homeowner’s primary residence. Secondary homes, rental properties, and vacation homes do not qualify for this exemption.

- Ownership Status: The homeowner must hold legal title to the property. This requirement ensures that the benefits of the exemption go to the actual property owner.

- Application Process: Homeowners must apply for the Homestead Exemption through their local tax assessor’s office. The application typically involves providing proof of residence and ownership.

Once approved, the Homestead Exemption provides a substantial reduction in the assessed value of the property, thereby lowering the total tax owed. For example, if a homeowner’s property is assessed at $200,000, the exemption might reduce the taxable value to $100,000, effectively cutting the tax bill in half.

The Homestead Exemption is particularly beneficial for senior citizens, disabled persons, and low-income homeowners, offering additional reductions or complete exemptions in some cases. These additional benefits help protect vulnerable populations from the financial strain of property taxes.

Conclusion

Navigating property taxes in Huntsville involves understanding the variable tax rates for different property types and leveraging available exemptions. Farmlands and managed forests enjoy lower tax rates to support their economic and environmental contributions, while residential and commercial properties are taxed at standard rates.

The Alabama Homestead Exemption offers significant relief to eligible homeowners, making property taxes more manageable. By staying informed about these factors, property owners can optimize their tax strategies and make informed decisions, ensuring they meet their financial obligations efficiently and effectively.