Buying a home is a big decision that requires much more consideration than you may realize. Should you continue renting your current home? Should you buy it? Are you moving to a new place and thinking of buying or renting a home?

When making this decision, you need to think of more than the convenience of having a house under your name. Do you plan to stay at your current job? Plan to have the kids school in the place or do you want to be flexible?

Renting a house has its pros and cons and so does buying one. This calls for research becasue these housing decisions have a huge impact on your life away from home.

1. Your Financial Situation

Having a budget is a foundation for any lifestyle choices we make, especially one as big as renting or buying a house. Both options come with their own sets of costs and financial commitments, and being well-prepared can help you avoid common pitfalls.

Knowing how much you can afford will help you set realistic expectations and avoid financial strain. Factor in all your income sources, monthly expenses, and savings goals and determine how much your housing budget is.

Keep in mind that your credit score influences the type of financing options available and the interest rates you’ll be offered. A higher credit score can open doors to better mortgage terms, potentially saving you thousands of dollars over the life of the loan.

Factor in both upfront costs (down payment, closing costs, and various fees) and ongoing costs (mortgage payments, property taxes, insurance, maintenance, and repairs) associated with each option. Renting includes a security deposit and possibly the first and last month’s rent, which is usually less than the upfront costs of buying.

2. Lifestyle Considerations

Your lifestyle is a reflection of your personal and professional choices, and it impacts various aspects of your living situation. Whether you prioritize flexibility due to frequent relocations or value stability for long-term roots, your lifestyle preferences will significantly shape your decision to rent or buy.

Renting often provides greater flexibility, allowing for easier relocation without the long-term commitment that comes with homeownership. This can be particularly beneficial for individuals with jobs that require frequent moves or those who enjoy exploring new areas.

Buying a home ties you to a specific location, making it less convenient to move on short notice. Homeowners may face challenges such as selling the property or managing a mortgage while transitioning to a new place.

3. Market Conditions and Timing

Before you buy or rent a house, look into the housing market and trends of the specific area. Market conditions can fluctuate due to many factors, including interest rates, inflation, and regional economic health.

In a seller’s market, where demand outpaces supply, home prices tend to rise, making it more challenging for buyers to find affordable properties. On the other hand, a buyer’s market, characterized by an abundance of homes and fewer buyers, can offer more favorable conditions for purchasing a home.

In areas with high rental demand and low vacancy rates, rent prices may be higher, making renting less affordable. Conversely, in markets with high vacancy rates, renters might find better deals and more negotiating power.

If you’re keeping an eye on rental market trends, you’ll be able to identify the best times to secure a lease. For instance, if rental prices are decreasing or stabilizing, it might be advantageous to rent rather than buy.

4. Investment Perspective

If you are unsure about staying at a specific place for a long but still want to buy a house, making a choice through an investment lens can help you decide. It’s not just about finding a place to live but also about considering the potential financial returns and risks associated with homeownership versus renting.

You can build equity over time which represents the portion of the property that you own outright, which increases as you pay down your mortgage and as the property’s value appreciates. Building equity can provide a sense of financial security and can be leveraged for loans or lines of credit, adding to your overall financial portfolio.

Renting, on the other hand, does not offer the opportunity to build equity. Monthly rent payments do not contribute to ownership, and renters do not benefit from property appreciation.

Take into account appreciation and depreciation when thinking of choosing whether to buy or rent. Renters are not exposed to the risk of property depreciation, but they also do not benefit from potential appreciation.

5. Tax Implications

Taxes are an important aspect of any financial decision, especially when it comes to housing. The tax implications of renting and buying can vary greatly, whether it’s through deductions or through credits.

A significant tax advantage of homeownership is the ability to deduct mortgage interest from your taxable income. This deduction can save you substantial tax savings, especially in the early years of the mortgage when interest payments are higher.

As a homeowner you can also benefit from tax deductions related to home improvements and energy-efficient upgrades. The deductions can help offset the costs of maintaining and enhancing your property.

While renting does not offer the same tax benefits as homeownership, there are still some tax considerations to keep in mind. In certain states or municipalities, renters may be eligible for tax credits or deductions related to rental payments and you also don’t have to pay property taxes as a tenant.

Pros and Cons of Renting

Deciding to rent a home is a choice many people make based on their current lifestyle, financial situation, and future plans. Renting offers unique benefits that cater to those seeking flexibility and lower upfront costs.

However, it also comes with certain limitations that may influence long-term stability and financial growth.

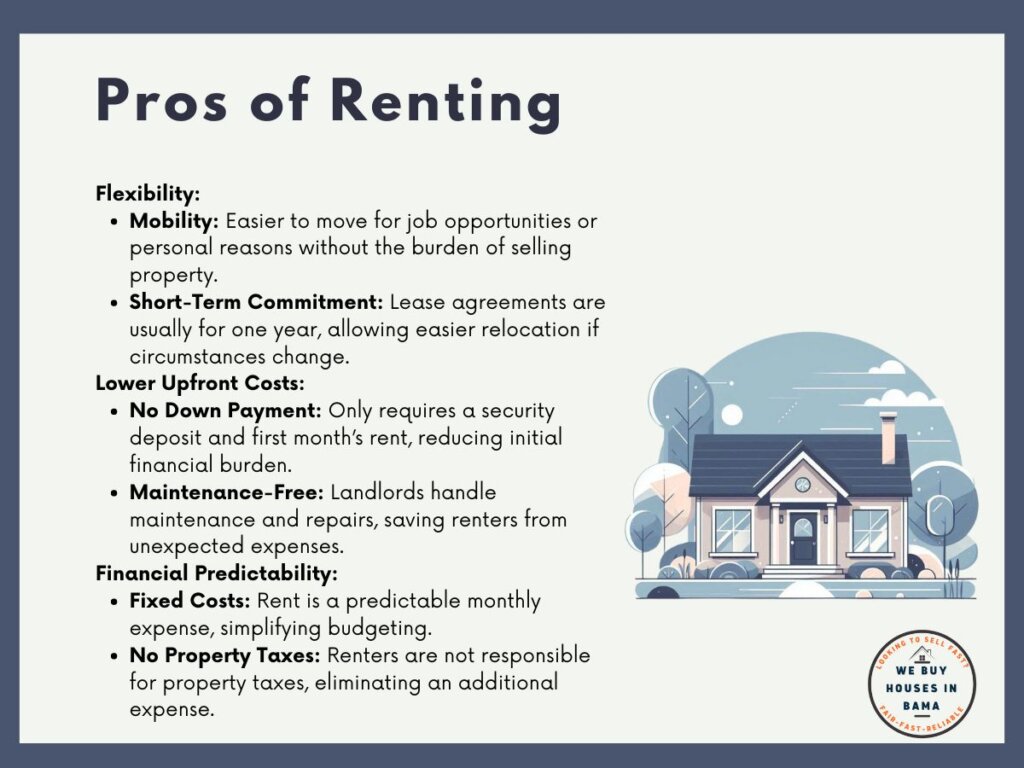

Pros of Renting

Renting a home puts you out of the strings of maintenance fees, related taxes, and other landlord expenses. Unexpected emergencies will not be at your expense as well.

1. Flexibility

- Mobility: Renting allows for greater flexibility to move for job opportunities or personal reasons without the burden of selling a property. This is especially beneficial for individuals with careers that require frequent relocation.

- Short-Term Commitment: Lease agreements typically last one year, making it easier to relocate if your circumstances change. This short-term commitment can be ideal for those who are not ready to settle down in one place.

2. Lower Upfront Costs

- No Down Payment: Renters do not need to save for a down payment, only a security deposit and the first month’s rent. This significantly reduces the initial financial burden compared to buying a home.

- Maintenance-Free: Landlords are generally responsible for maintenance and repair costs, reducing unexpected expenses for renters. This can lead to considerable savings over time.

3. Financial Predictability

- Fixed Costs: Rent is usually a predictable monthly expense, which can simplify budgeting. Knowing exactly how much you will spend each month on housing can provide financial peace of mind.

- No Property Taxes: Renters are not responsible for property taxes, which can vary significantly. This eliminates another variable expense from the budget.

Cons of Renting

Renting a home puts you on a clock everytime you renew your lease. This limits you in what you can do and any improvements made will be to your landlord’s advantage.

1. No Equity Building

- Lack of Investment: Rent payments do not contribute to building equity or owning an asset. Over time, this can mean a significant amount of money spent without any return.

- No Return on Investment: At the end of the lease, renters do not have a tangible asset to show for their payments. This contrasts with homeowners who build equity and potential wealth through property ownership.

2. Limited Control

- Restrictions: Renters may face restrictions on decorating, renovating, or having pets. These limitations can affect personal comfort and the ability to personalize one’s living space.

- Lease Terms: Rent increases and lease renewal decisions are at the landlord’s discretion. This can lead to unexpected changes in living costs or the need to find new housing on short notice.

3. Instability

- Eviction Risk: Renters may face eviction if the landlord decides to sell the property or not renew the lease. This lack of long-term security can be stressful and disruptive.

- Rent Increases: Rent can increase with each lease renewal, potentially making it less affordable over time. This can impact long-term financial planning and stability.

Pros and Cons of Buying

Buying a home allows individuals to invest in an asset that can be appreciated over time, providing potential financial returns. Homeownership also offers a sense of permanence and control over your living environment, which can be appealing to those looking to settle down.

However, buying a home comes with its own set of challenges and responsibilities.

Pros of Buying

Owning a home gives you the ability to do to it as you want in either customization or even renting it out. You also have the ability to build its equity over the years any square footage added in improvements or the amazing landscaping will be appealing to prospectiv buyers if you decide to sell it.

1. Equity Building

- Investment: Monthly mortgage payments contribute to building equity in a property. This can lead to significant financial growth as you pay down your mortgage and the property’s value appreciates.

- Appreciation: Over time, property values may increase, providing potential profit if the home is sold. Real estate can be a valuable part of a long-term investment strategy.

2. Stability

- Fixed Payments: Fixed-rate mortgages offer predictable monthly payments, making long-term financial planning easier. This stability can be comforting compared to the potential variability of rent.

- Permanent Residence: Homeowners do not have to worry about lease renewals or landlord decisions. This permanence allows for long-term planning and stability in your living situation.

3. Control and Customization

- Freedom to Renovate: Homeowners can modify and renovate their homes to suit their tastes and needs. This control allows you to create a living space that truly feels like home.

- Pride of Ownership: Owning a home can provide a sense of stability and personal accomplishment. It can also foster a deeper connection to your community.

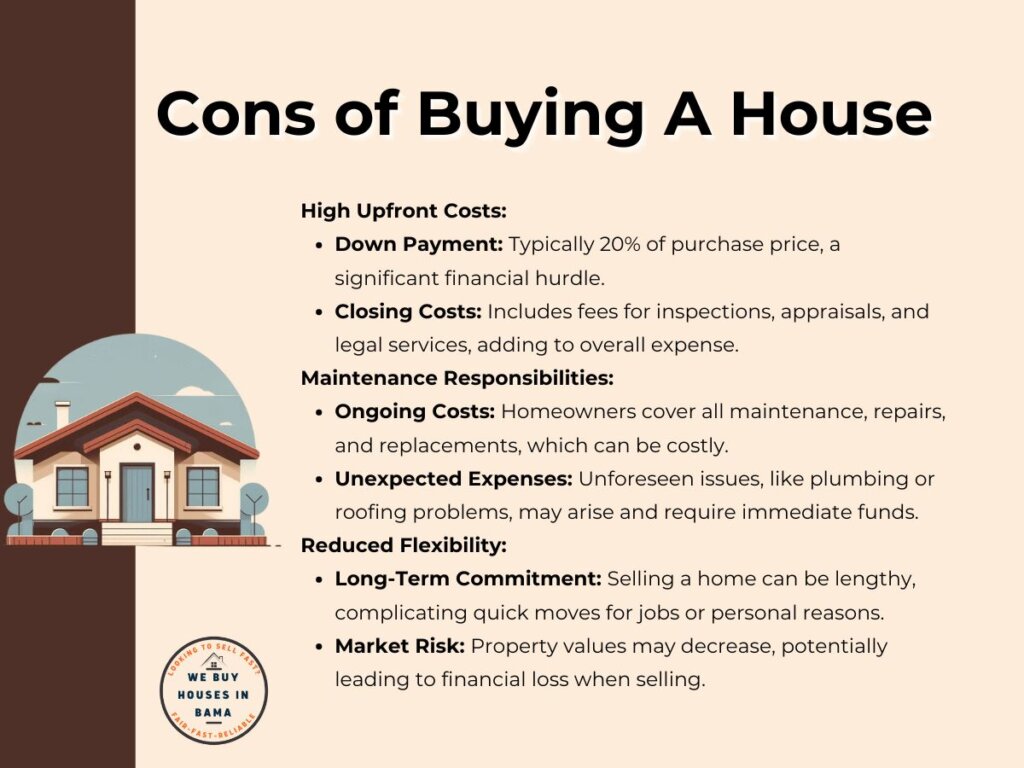

Cons of Buying

Renting a house is a normal part of our daily lives but some don’t see it as a long-term solution since you’re not building equity. Some may see it as throwing away the money that could be saved by let’s say, renting to own.

1. High Upfront Costs

- Down Payment: Buying a home typically requires a substantial down payment, often 20% of the purchase price. This can be a significant financial hurdle for many potential buyers.

- Closing Costs: Additional costs at closing can add up, including fees for inspections, appraisals, and legal services. These expenses can be substantial and should be factored into the overall cost of buying a home.

2. Maintenance Responsibilities

- Ongoing Costs: Homeowners are responsible for all maintenance, repairs, and replacements, which can be costly and time-consuming. Regular upkeep is necessary to maintain the property’s value and condition.

- Unexpected Expenses: Unforeseen issues, such as plumbing or roofing problems, can arise and require immediate attention and funds. These unexpected costs can strain a homeowner’s budget.

3. Reduced Flexibility

- Long-Term Commitment: Selling a home can be a lengthy process, making it harder to move quickly for job opportunities or personal reasons. This lack of flexibility can be challenging for those with changing circumstances.

- Market Risk: The housing market can be volatile, and property values may decrease, potentially leading to a loss if the home is sold. This market risk can impact the financial benefits of homeownership.

Understanding Property Taxes in Huntsville: A Comprehensive Guide

It’s important to remember that there is no one-size-fits-all answer when it comes to renting versus buying. Your unique circumstances, future plans, and financial health all play a significant role in determining the best choice for you.

For those planning to buy house instead, there are a number of associated taxes that come with being a homeowner. Knowing these property taxes will give you room to prep financially and also be legally informed to avoid any issues down the road.

If you’re not ready for the property taxes in Hunstville, renting a house may be the best option since the renting/ leasing taxes are the lessor’s responsibility.